You’ve probably heard the saying, “Don’t put all your eggs in one basket.” When it comes to your investment portfolio, this is excellent advice.

When people think of investing money, they usually go straight to the stock market. This way of thinking isn’t a bad one. The stock market can help you accrue wealth and assets over time.

However, the stock market also fluctuates, especially in the COVID era. If you want a way to hedge your assets from inflation or volatile markets, precious metals investing is the solution.

But, before you start investing, do your due diligence. You’ll have an easier time with your investments if you know how to invest.

To that end, we’ve compiled this article on how to invest in precious metals. We hope it helps!

What Are Precious Metals?

When investors talk about precious metals, they have four in mind: gold, silver, platinum, and palladium. Sometimes, other metals make their way onto the list, such as rhodium or copper. However, these are exceptions to the rule.

Each of these metals has extensive use in technology. For example, gold wiring is a core component of smartphones. Smartphone screens often require portions of silver. Platinum and palladium play vital roles in the automobile industry.

However, each of these can also be a way of securing your assets. We’ll discuss the different investment options below.

Methods of Precious Metals Investing

There are three primary ways of investing in precious metals. These include investing in coins, bars, or rounds.

Coins are the most recognizable type of precious metal product. As recently as the 20th century, governments still issued these coins for money.

Now, government mints make precious metal coins exclusively for investors. Often, these coins include an engraving of a national symbol in the design.

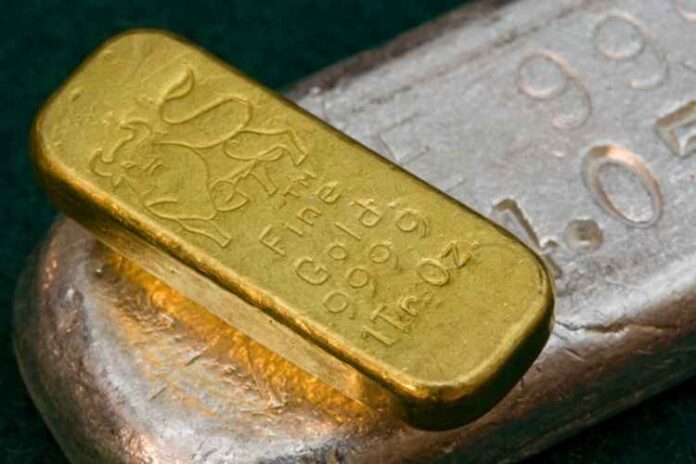

After coins, the next precious metals investing opportunity is buying bars. Bars come from private mints instead of government issues. An advantage of these is that they are more efficient for storage.

People are often surprised to learn that bars are less expensive than coins. This is because bars don’t have intricate designs like bullion coins.

Bars may also have a lower carat value compared to bullion coins. You can learn more about this at http://www.raremetalblog.com/carat-vs-karat-whats-the-difference/.

Finally, there are rounds. Rounds have a similar shape to coins but also come from private mints. Usually, rounds use either gold or silver for their designs. You can also get rounds in several artistic medallion styles.

Investing Tips

Before you invest, here are some tips to keep in mind. First, plan ahead with your storage plans.

You may want to store your precious metals at home. If so, make sure you keep them in a secure safe. Otherwise, you can pay a facility to store your precious metals.

Also, keep in mind that metal prices constantly fluctuate. However, this fluctuation differs from that of the stock market.

Precious metal prices come from supply and demand. Prices go down when more people want to buy metals than sell them. When you place your order, the price locks after the finalization.

Invest in Precious Metals Today

Following the best investing advice can save you a lot of trouble down the line. So, continue researching to find the best precious metals investing opportunity for you!

We hope you enjoyed this article! If so, check out other content today.